Asia ex Japan Equity

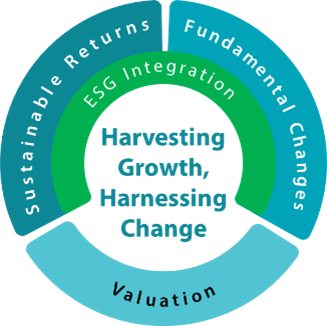

We seek to identify undervalued companies capable of achieving high sustainable returns and benefiting from positive fundamental change to capture superior returns in Asia; one of the most dynamic and fast changing regions in the world.

We believe that strong or improving Environmental, Social, and Governance (ESG) performance is essential for generating higher sustainable returns.

We term the above as “Harvesting Growth, Harnessing Change”.

We aim to have a balanced portfolio with the largest representation of stocks with undervalued high sustainable returns and positive fundamental change, with ESG Risks and Returns analysis integrated throughout.

A dynamic market transforming itself at an unprecedented speed. Capturing value from diverse Asian opportunities requires deep understanding and cultural awareness.

|

Growing opportunity set of potential investments in Asia, there are 50% more listed equities in Asia ex Japan today versus 10 years ago (>30,000). The combined US and EU equity listings have shrunk over that time 1 |

|

1 billion Asians set to join middle class by 2030, while it is set to shrink in Japan, Germany and others 2 |

|

|

China poised to become the world’s largest economy by 2030, India set to become the 2nd largest economy by 2050 3 |

|

Supplier to the world, increasingly cutting edge [> 85% of global Semiconductor Foundry 4 | > 85% Electric Vehicle Battery 5 | > 85% Solar (Polys, Modules, Cells) 6] |

1 Source: Bloomberg, Feb 2023

2 Source: World Data Lab, September 2021

3 Source: S&P Global – Market Intelligence, November 2022

4 Source: Statista, https://www.statista.com/statistics/867223/worldwide-semiconductor-foundries-by-market-share/, September 2022

5 Source: Bloomberg NEF, June 2022

6 Source: Bloomberg NEF, May 2022

A dynamic market transforming itself at an unprecedented speed. Capturing value from diverse Asian opportunities requires deep understanding and cultural awareness.

Growing opportunity set of potential investments in Asia, there are 50% more listed equities in Asia ex Japan today versus 10 years ago (>30,000). The combined US and EU equity listings have shrunk over that time 1

Growing opportunity set of potential investments in Asia, there are 50% more listed equities in Asia ex Japan today versus 10 years ago (>30,000). The combined US and EU equity listings have shrunk over that time 1

![]() 1 billion Asians set to join middle class by 2030, while it is set to shrink in Japan, Germany and others 2

1 billion Asians set to join middle class by 2030, while it is set to shrink in Japan, Germany and others 2

China poised to become the world’s largest economy by 2030, India set to become the 2nd largest economy by 2050 3

China poised to become the world’s largest economy by 2030, India set to become the 2nd largest economy by 2050 3

Supplier to the world, increasingly cutting edge

Supplier to the world, increasingly cutting edge

[> 85% of global Semiconductor Foundry 4 | > 85% Electric Vehicle Battery 5 | > 85% Solar (Polys, Modules, Cells) 6]

1 Source: Bloomberg, Feb 2023

2 Source: World Data Lab, September 2021

3 Source: S&P Global – Market Intelligence, November 2022

4 Source: Statista, https://www.statista.com/statistics/867223/worldwide-semiconductor-foundries-by-market-share/, September 2022

5 Source: Bloomberg NEF, June 2022

6 Source: Bloomberg NEF, May 2022

A unique and dynamic market requires a team approach of the same character.

Diversity of perspectives

We rely on the individual creativity and unique backgrounds of our team to produce varied, often unexpected insights into these sizable, fast-paced markets

Team mentality & mutual respect

An environment of trust, cohesion, and respect is the foundation for challenging, and subsequently integrating individual insights into a broader, coherent picture

Bottom-up approach

Relying on input from experts on the ground to generate the building blocks of the best investment ideas

- Over 20 investment professionals based in Singapore, Hong Kong and Shenzhen

- 19 years of average industry experience

- 10 primary nationalities

- All major Asian languages spoken

- Diversity across cognition, culture and demographics

- Mutual Respect, the foundation of our collaboration

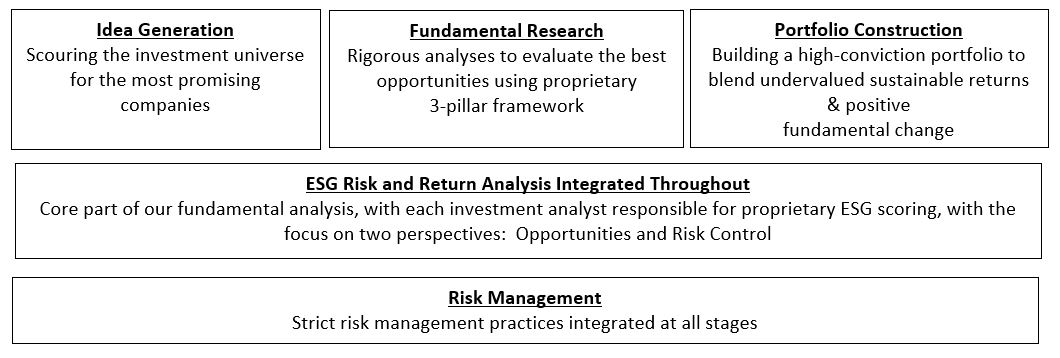

Tailored for the complexities of Asian markets and fundamental change.

Scouring the investment universe for the most promising companies

Rigorous analyses to evaluate the best opportunities using proprietary

3-pillar framework

Building a high-conviction portfolio to blend undervalued sustainable returns & positive

fundamental change

Core part of our fundamental analysis, with each investment analyst responsible for proprietary ESG scoring, with the focus on two perspectives: Opportunities and Risk Control

Strict risk management practices integrated at all stages

- Over 20 investment professionals based in Singapore, Hong Kong and Shenzhen

- 19 years of average industry experience

- 10 primary nationalities

- All major Asian languages spoken

- Diversity across cognition, culture and demographics

- Mutual Respect, the foundation of our collaboration

ESG Risk and return analysis is integrated across the entire investment process, supported with the following ESG beliefs:

- Strong or improving ESG is essential for higher sustainable returns

- Focus on what’s material for Asia

- Investment analyst led assessment works best

|

Concentrated exposure to a dynamic market transforming itself at an unprecedented speed |

|

Finding the best companies characterized by undervalued positive fundamental change & sustainable returns |

|

A strong institutional investment process tailored for the complexities of the Asian markets |

| ESG risk and opportunity analysis integrated across investment process | |

|

Diversity of backgrounds & perspectives, and local partnerships to generate the best investment ideas |

The funds mentioned are Singapore registered funds approved for sale or purchase in Singapore. By proceeding, you are representing and warranting that you are either resident in Singapore or the applicable laws and regulations of your jurisdiction allow you to access the information.

The information on this website is not intended to be an offer, or a solicitation of an offer, to buy or sell any product or service to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction.

This website may contain links to the website of certain overseas affiliates of Nikko Asset Management Asia Limited (“Nikko AM Asia”). However, providing such links should not be considered as offering or solicitation by Nikko AM Asia of any product or service of its affiliates to any person.

This website is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. The mention of individual securities, sectors, regions or countries within this website are for illustration purposes only and does not imply a recommendation to buy or sell. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko AM Asia.

Past performance or any prediction, projection or forecast is not indicative of future performance. The Funds or any underlying funds may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Funds are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Funds, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Funds.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this website.

Sustainability in action

This site is designed to be light in carbon footprint. We strive to deliver a smoother experience, using less energy with a simplified code, light vector graphics and by reducing unnecessary features and plugins. We regularly review and archive content to reduce impact on the environment.